STOP! Have You Updated Your Will in the Last 10 Years?

Life moves quickly. Sometimes, something you have every intention of doing gets pushed off repeatedly. It feels like you blink, and ten years go by. It happens to all of us. But, it is time to stop procrastinating! You must review and when necessary, update your essential documents like your Will. Trust us, your future self and family will thank you for it.

Have you recently bought a home? Gotten married? Lost a loved one? Gotten a divorce? Had a child?

It is imperative to update your documents to reflect these significant life events. Whether the circumstances were happy or sad, good or bad, they can substantially impact your future life plans, including your estate, estate plan, wealth, and your ability to support yourself, your children, and your loved ones, financially and otherwise.

We understand that it can feel overwhelming just to think about getting this taken care of. But we can promise you that having a plan in advance is much less overwhelming than having no plan when you need it most.

Reviewing and updating your important documentation every ten years or at any major life changes help ensure your best interests and your wishes are taken care of. As we age, our wishes may change.

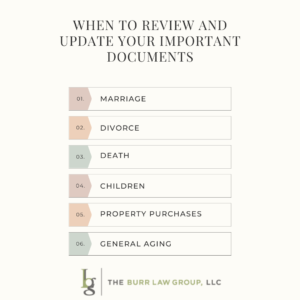

In each of these situations (and more)…

- marriage

- divorce

- death

- property purchases

- children

- general aging

So besides your Will, what other important documents should you review?

Your real property deeds are one of them. Do you know today who is on your deed? While it can be challenging to think about these questions, it is essential to ask yourself, “What happens to my home if I die? What will come of my business if I die? Have I accomplished my financial goals to support my loved ones in the future and beyond?” and so many others.

What about a Power of Attorney? Do you have this in place? If you are unfamiliar with what a Power of Attorney (POA) is, it refers to the legal authorization that gives a designated person the power to act for someone else. So if you or a loved one becomes incapacitated, this document ensures you can adequately care for your family or that you will properly care for yourself. A Power of Attorney will eliminate the need to go to court and be appointed a guardian if you or your loved one becomes incapacitated. A guardianship procedure will cost you thousands of dollars. A POA is a simple document that will cost you a couple hundred dollars, but their protections are priceless.

Every new life event can alter crucial life decisions, and these essential documents need to be reviewed to determine if they still do what you intend for them to do.

So please, take the time to read your deed, your Will, your POA, and your life insurance policy. If you do not have a power of attorney, one should be drafted for you and your loved ones in case of a change in health.

At the Burr Law Group, we can help draft your Will, Deed, and Power of Attorney to ensure that your wishes are protected. While it can be an uncomfortable conversation, these matters must be addressed. Please don’t wait until it’s too late. Revisit these documents every ten years to avoid preventable headaches.